Be Greedy When Others Are Fearful?

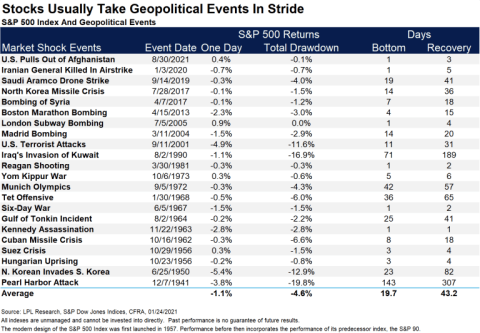

I work with farm operations on their retirement investments in addition to providing commodity strategies and I wanted to provide you some information on past geo political events (see chart below).

Bottom line, markets in the past do recover from these geo political events IN TIME.

There are always opportunities if you have someone looking for them.

"Be greedy when others are fearful and fearful when others are greedy." - Warren Buffet

Now onto my thoughts on the commodity markets.....

I don't think I have to reiterate what is going on in the world right now is causing volatility in all markets right now.

Currently as I write this...

- Canola up $25t

- Minne wheat up 30 cents/bu

- Chicago up 55 cents/bu

- Soybeans up 43 cents/bu

- Corn up 28 cents/bu

- WTI oil up $3.63/bbl and

- Gold up $25oz

These "live quotes" will all probably be outdated in a couple minutes (or less).

This month Stats Can reported canola stocks were down 43.1% year over year to 7.6 million tonnes, which is the lowest level since 2007.

Despite strong international demand, exports fell compared to last year.

Industrial use, mainly canola crush, fell 13% to 3.8 million tonnes

I'm talking with clients about how much canola they still have in the bin and when they need to move it for cash flow or to make room for next years crop.

The May contract reached a new all time high briefly of $1092.2t this month.

If you need to sell your canola in the bin still, consider how you can sell at these near contract highs and then replace it using futures or options.

There are still positive factors for canola to reach new highs with how the soy and other vegetables markets are trading.

Plenty of weather uncertainty is driving volatility in soybeans and soy oil, which have recently rallied.

A jump in palm oil and the continued surge in energy prices have added to the bullish tone.

Palm oil futures hit all time highs recently with production difficulties in Malaysia and Indonesia's export restrictions.

Replacing your physical canola using futures or options takes away guessing if the price is going to keep going higher.

It "locks-in" a very profitable price for your physical canola and still gives you the upside in the market.

Keep in mind you don't have to replace all the physical canola you sold giving you more marketing flexibility.

I'm still bullish on canola prices for this year, but if there is a time constraint when you have to sell you want to be proactive rather than reactive given these prices.

A jump in palm oil and the continued surge in energy prices have added to the bullish tone.

Canola May Futures - 1 Year

Chart sourced from Market Q

Wheat

Russia is the world's largest exporter of wheat, while Ukraine is the fifth largest exporter and many Black Sea export terminals are currently closed.

On top of the current year export situation, traders are nervous that the conditions for Ukraine yield are far from ideal.

Also, harvest activity for the 2022 wheat crop is in question as Ukraine producers are unlikely in a position for taking care of their crop.

May Chicago wheat on Friday closed 75 cents lower and now today back up 54 cents.

The sweeping outside day down on Friday might be a sign of a key reversal suggesting a top is in place if today's gain isn't held.

The general idea that the Black Sea region will see export terminals reopen soon to avoid much of a slowdown in exports from the region could pressure prices lower.

One thing I always keep in mind is that the best traders are more concerned about losing money than making money and with the markets right now the opportunity might not be worth the risk.

I'm putting more of my "hedging hat" on and looking at option strategies to take advantage of these new crop prices.

Minneapolis Wheat May Futures - 1 Year

Chart sourced from Market Q

Chicago Wheat May Futures - 1 Year

Chart sourced from Market Q

Kansas City Wheat May Futures - 1 Year

Chart sourced from Market Q

Corn

Until there is some hope that the Ukraine/Russia conflict will be resolved, or at least will not impact grain exports in a major way, buyers are likely to be active on pullbacks.

Open interest showed aggressive long liquidation selling for corn in recent days.

I could see that being profit taking going into the week end with traders reducing their risk over the weekend.

U.S. demand is already strong due to sharp reductions in South America production, and demand will just strengthen if Ukraine is unable to export.

From a technical perspective, corn is in a steep uptrend and I have $6.55/bu as support and $7/bu as resistance.

Corn May Futures - 1 Year

Chart sourced from Market Q

Cattle

For the Cattle on Feed report last Friday, placements for the month of January came in at 98.8% of last year as compared with the average trade expectation 99.2% of last year.

This is slightly supportive against trade expectations and near the low end of the range.

January marketing's came in at 96.9% as compared with expectations for 97.3% of last year.

This is slightly bearish.

As a result, the On-Feed supply for February 1 came in at 100.8% of last year, which was right near the expectation of 100.7% of last year.

The USDA report news was very neutral and shouldn't have too much of an impact in trading.

Traders will probably be watching more how corn futures have rallied significantly and is putting downward pressure on cattle.

Feeder Cattle April Futures - 1 Year

Chart sourced from Market Q

Live Cattle April Futures - 1 Year

Chart sourced from Market Q